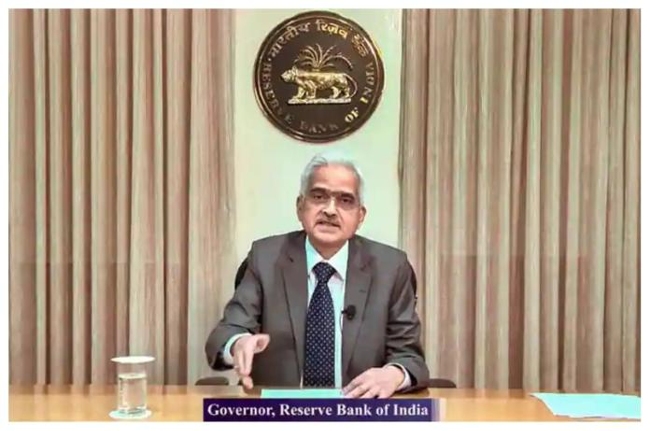

New Delhi – Reserve Bank of India (RBI) has hiked the repo rate by 0.50%, taking it to 5.90% from 5.40%. It will result in raising interest on various loans such as housing, vehicle, personal, etc. leading to an increase in the EMI (Equated monthly instalment) for the borrowers. The above information was given by RBI Governor Shaktikanta Das at a press conference. The repo rate was increased from 4.90% to 5.40% in the meeting held in August.

#RBIPolicy | RBI raised the repo rate for the fourth time in a row today. Here’s how it will impact you #RBI #MonetaryPolicy #RepoRate #RateHike #IndianEconomyhttps://t.co/Gr6sc4gOjp

— Business Standard (@bsindia) September 30, 2022

Consequences of hike of 0.50%

If a person borrows Rs. 30 lakhs as a housing loan with 8.05% interest for a 20-year repayment period, his EMI will be Rs. 25,187/- which means he will end up paying Rs. 60,44,793/- for the loan of Rs. 30 lakhs, when earlier for the same loan amount, he had to pay as Rs. 58, 42,000/- with 7.95% interest for 20 years.

(Credit: Zee Business)

What is the repo rate ?

The rate at which banks borrow money from RBI is known as the repo rate. A hike in the repo rate means an increase in the interest rate on loans taken from RBI. A decrease in the repo rate means banks will get loans at a low rate of interest; therefore, people have to pay more when the RBI increases the repo rate.

Rape of a young woman by Pastor Jashan Gill in Gurdaspur (Punjab)

Rape of a young woman by Pastor Jashan Gill in Gurdaspur (Punjab) Young woman abducted and gang-raped by Muslims in Bengaluru

Young woman abducted and gang-raped by Muslims in Bengaluru In Bengal, unidentified persons set fire to a worship pandal and Deities Idols

In Bengal, unidentified persons set fire to a worship pandal and Deities Idols In Jashpur, Chhattisgarh, female students are being pressured to convert to Christianity at a Christian missionary-run college

In Jashpur, Chhattisgarh, female students are being pressured to convert to Christianity at a Christian missionary-run college Shriram Navami celebrated with great enthusiasm across the country

Shriram Navami celebrated with great enthusiasm across the country President Murmu approves ‘Waqf Amendment Bill’

President Murmu approves ‘Waqf Amendment Bill’