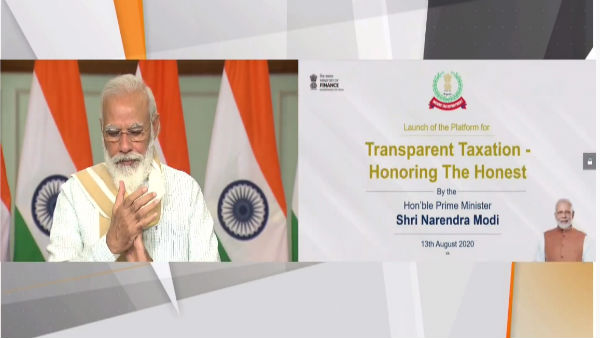

New Delhi – In a bid to reward the taxpaying citizens of India, Prime Minister Narendra Modi launched a platform which will honour the honest taxpayers.

Unveiling the “Transparent Taxation – Honouring the Honest” platform through video conferencing, the Prime Minister also laid out the next phase of reforms of the direct taxes which is aimed at easing the tax compliance and also rewarding honest taxpayers in the midst of COVID-19) pandemic which has severely hit the Indian economy because of the rising number of cases and the lockdowns.

Modi in his tweet on Wednesday had said that this platform will add strength to the Government’s efforts of reforming and simplifying the tax system. “It will benefit several honest tax payers, whose hardwork powers national progress,” he wrote on Twitter.

The Central Board of Direct Taxes (CBDT) has carried out several major tax reforms indirect taxes in recent years. Last year the Corporate Tax rates were reduced from 30% to 22 % and for new manufacturing units, the rates were reduced to 15%. Dividend distribution Tax was also abolished.

Speaking on the occasion, the Prime Minister said that the new platform will be having faceless assessments, faceless appeal and taxpayer charter. The faceless assessment and taxpayer charter will come into place from today itself, while the faceless appeal is going to be applicable from 25th September.

Modi said that fundamental reforms were needed in the tax system of India and said that his Government’s effort is to make tax system seamless, painless and faceless. He said that in a country of 130 crore people only 1.5 crore citizens were paying taxes. (Why Indians do not pay their taxes ? It should be investigated and they should be asked to pay tax. Public should also see to it that the tax they are paying is utilised properly by the Government ! – Editor)

During the speech, the prime minister said that every rule, law and policy is being taken out of power centric approach and is now being turned into people-centric and public friendly. This, he said, is the use of the new governance model of the new India.

He said that tax compliance becomes difficult when there is complexity. Modi said that if the law on tax is easy and clear, then the taxpayers are happy and so is the country. He explained that this work has been in process for some time and now, goods and services tax (GST) has come in place of dozens of taxes.

Modi also urged citizens who are not in the tax net to come forward and file tax returns. “Those who are able to pay tax, but they are not in the tax net yet, they should come forward with self-motivation, this is my request and hope,” the Prime Minister said before concluding his speech.

#LIVE | Transparent taxation system is very important. This platform we are launching today will make the tax system faceless. We are starting a new journey today: PM Modi launches a new tax platform – ‘Transparent Taxation – Honouring the Honest’. pic.twitter.com/HdJolgTUET

— CNNNews18 (@CNNnews18) August 13, 2020

Every Indian must watch ‘The Sabarmati Report’ movie : Chief Minister Yogi Adityanath

Every Indian must watch ‘The Sabarmati Report’ movie : Chief Minister Yogi Adityanath No evidence against India or Prime Minister Modi : Trudeau Govt

No evidence against India or Prime Minister Modi : Trudeau Govt SC issues notice to Muslim party in Gyanvapi case

SC issues notice to Muslim party in Gyanvapi case Demand to declare Indigenous Cow as Rashtramata

Demand to declare Indigenous Cow as Rashtramata If a relationship with consensual physical intimacy later ends, rape or sexual harassment charges cannot be filed

If a relationship with consensual physical intimacy later ends, rape or sexual harassment charges cannot be filed Special Interview : Efforts like increasing the number of polling stations have led to a rise in voter turnout : S. Chokalingam, Chief Election Officer

Special Interview : Efforts like increasing the number of polling stations have led to a rise in voter turnout : S. Chokalingam, Chief Election Officer