Union Budget for 2022

Reserve Bank to introduce cryptocurrency called ‘Rupee’

400 ‘Vande Bharat’ trains will operate

5G mobile service will be launched from this year

New Delhi – Union Finance Minister Nirmala Sitharaman presented the budget for the year 2022 in the Lok Sabha on 1st February. The general populace was expecting a change in tax structure this year; however, this budget was only disappointment in this regard. Like last year, tax exemption has been given up to ₹2.5 lakh and for the elderly up to ₹3 lakh. At the same time, the corporate tax has been reduced from 18% to 15%. The Reserve Bank will introduce a digital cryptocurrency called ‘Rupee’. Profits from this will be taxed at 30%. Like last year, Nirmala Sitharaman presented the budget using a Tablet.

#ShareMarket: opens on positive note a day after #Budget2022 #kalingatv https://t.co/RiAZez84hF

— Kalinga TV (@Kalingatv) February 2, 2022

Sitharaman said that the Government was working on a master plan of PM Gati Shakti Yojana. Under this scheme, huge investments will be made for roads, railways, water transport infrastructure in the near future, but State Governments also need to take initiative and participate in the development of the country’s infrastructure. A package of ₹1 lakh crore has been provided for the States’ economies.

Some highlights of the budget

1. The network of national highways will be extended up to 25,000 km for which ₹20,000 crores have been allocated.

2. Efforts will be made to create 60 lakh new jobs.

3. Target to build 80 lakh houses has been set under the PM Awas Yojana. A provision of ₹48,000 crores has been made for this.

4. E-passports will be issued in the year 2022-23. Chip-based passports will be issued as well.

5. A digital university will be set up.

6. In the next 3 years, 400 ‘Vande Bharat’ trains will ply.

7. The children in the villages had been deprived of education for two years due to the closure of schools during the pandemic. Now for such children, the programme ‘One Class – One TV Channel’ will be launched under ‘PM e-Vidya’ and the number of channels will be increased from 12 to 200. These channels will be in regional languages.

8. Organic farming will be promoted on the land falling within 5 km from the banks of river Ganga. Digitisation of farm documents will take place. States will be asked to change the curriculum of agricultural universities so as to reduce the cost of farming.

9. To increase the capacity of private investors, a provision of ₹7.55 lakh crore has been made from ₹5.54 lakh crore.

10. Taxes on co-operative societies with an income of ₹1 to ₹10 crores have been reduced from 12% to 7%.

11. The price of jet fuel has risen by a record 8.5%. Rising fuel prices could also increase airfares.

12. By 2025, an optical fibre network will be spread in all the villages of the country. Also, cheap internet will be made available in rural areas.

13. 3 schemes have been started for the integrated development of women and children. 2 lakh Anganwadis will be upgraded to improve the health of children.

14. Import duty on electronic goods will be waived. Mobile camera module lenses and chargers are also exempted from import duty.

15. A provision of ₹19,500 crores has been made for solar energy generation.

16. New charging stations for electric vehicles will be set up in the country. Due to insufficient space in cities, charging stations cannot be set up in large numbers. And hence, the ‘battery swapping’ scheme will be introduced for cities.

17. An ATM card will be available at the post office.

18. Registration of all lands in the country will be done online.

19. Real estate can be registered anywhere.

20. The price of a 19 kg commercial LPG cylinder has been reduced by ₹91.50. The new rates are effective from 1st February.

5G mobile service will be launched from this year

The 5G mobile service will be launched this year; however, the actual 5G service will be used from 2023. The spectrum required for private telecom establishments to launch 5G mobile services in the year 2022-23 will be auctioned off.

Farmers will also use drones

‘Agricultural drones’ will be used for farming. These agricultural drones will be used for crop inspection, land records, and pesticide spraying. Technology will be used more and more for agriculture and crop production.

After selling cars, registration can be done from anywhere in the country !

After selling the vehicles, they can be registered from anywhere in the country. A website will be set up to register these vehicles. A person residing in Mumbai or Pune will be able to register a vehicle through these cities even if his/her documents have the village address.

Which things will become cheaper ?

Clothes

Leather goods

Agricultural instruments

Mobile phones

Mobile phone related accessories, e.g., charger

Diamond jewellery

Polished diamonds

Camera lens

Imported chemicals

Expensive umbrellas

Which things will become more expensive?

Imported items

Umbrella

Deceptive Budget ! – Congress

‘The working class and middle class in India were expected to be relieved against the backdrop of pay cuts and inflation during the Covid-19 pandemic; however, the Prime Minister and the Finance Minister have disappointed with the decision not to grant direct tax relief. This budget is a deception of the Indian salaried and middle class’, Congress spokesperson Randeep Surjewala tweeted.

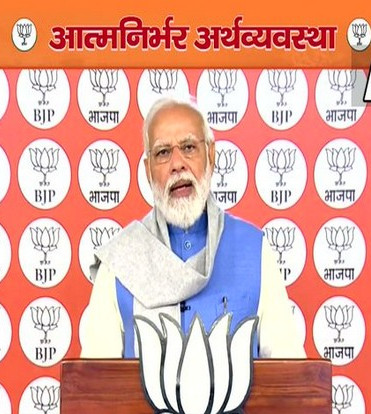

India’s Budget of the future ! – Devendra Fadnavis, Leader of Opposition, Maharashtra

‘Union Finance Minister Nirmala Sitharaman, led by Prime Minister Narendra Modi, has presented a budget that will make India more self-reliant and stronger. Most importantly, it is a budget that looks to the future of India. This is a budget that is more balanced on economic parameters, inclusive, and leads to development’, said Devendra Fadnavis, former Chief Minister of Maharashtra and Leader of Opposition in the Legislative Assembly.

Teacher in a Government school instructs students to bow to him instead of Deities

Teacher in a Government school instructs students to bow to him instead of Deities Election Commission directs the BJP to remove a campaign video

Election Commission directs the BJP to remove a campaign video Islamic extremists thrash a Muslim girl for going out with a Hindu boy

Islamic extremists thrash a Muslim girl for going out with a Hindu boy Petitioner withdraws defamation complaint against lyricist Javed Akhtar

Petitioner withdraws defamation complaint against lyricist Javed Akhtar “JMM Govt is giving shelter to Bangladeshis in madarasas” : BJP President J P Nadda

“JMM Govt is giving shelter to Bangladeshis in madarasas” : BJP President J P Nadda We Will Not Let India Become Like Bangladesh : Pandit Dhirendra Krishna Shastri

We Will Not Let India Become Like Bangladesh : Pandit Dhirendra Krishna Shastri